APX Lending’s 2025 year-end recap

A look back at APX Lending's first year: CSA authorization, market volatility, regulatory progress in Canada and the U.S., and what it means for the future of crypto-backed lending.

Crypto-backed loans are no longer fringe.

As the market matures, the difference between safety, clarity, and risk becomes clearer. And more important.

In our corner, we believe in providing borrowers with liquidity without sacrificing control, clarity, and compliance. That’s central to how we do things and ultimately feeds into our mission.

To accelerate crypto adoption through trust, transparency, and regulatory excellence.

With that said: Let’s see how we stack up against Coinbase’s approach.

APX Lending

We offer fixed APRs based on loan size irrespective of loan term or LTV. We offer tiered rates: 11.49% APR (<$100K), 10.99% APR ($100K–$1M), and 9.99% APR (>$1M).

That said, we’re always negotiating better terms with our partners- so keep that in mind.

There are no origination fees or hidden charges, and interest is simple (i.e. you pay only on the principal outstanding).

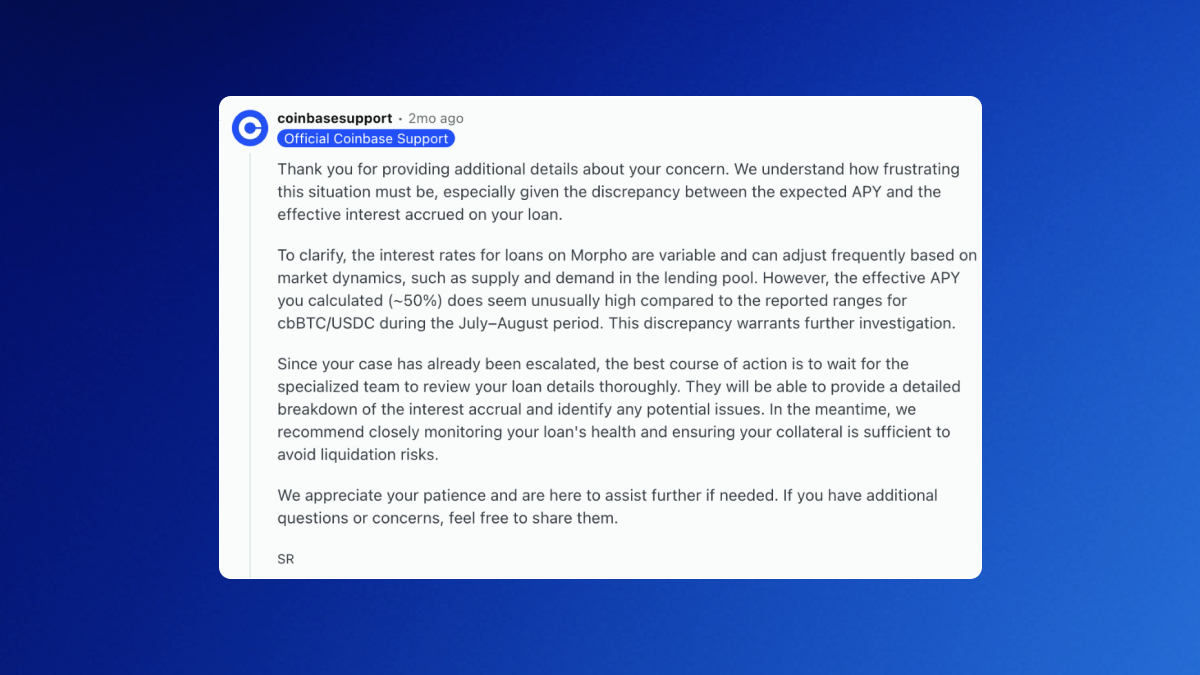

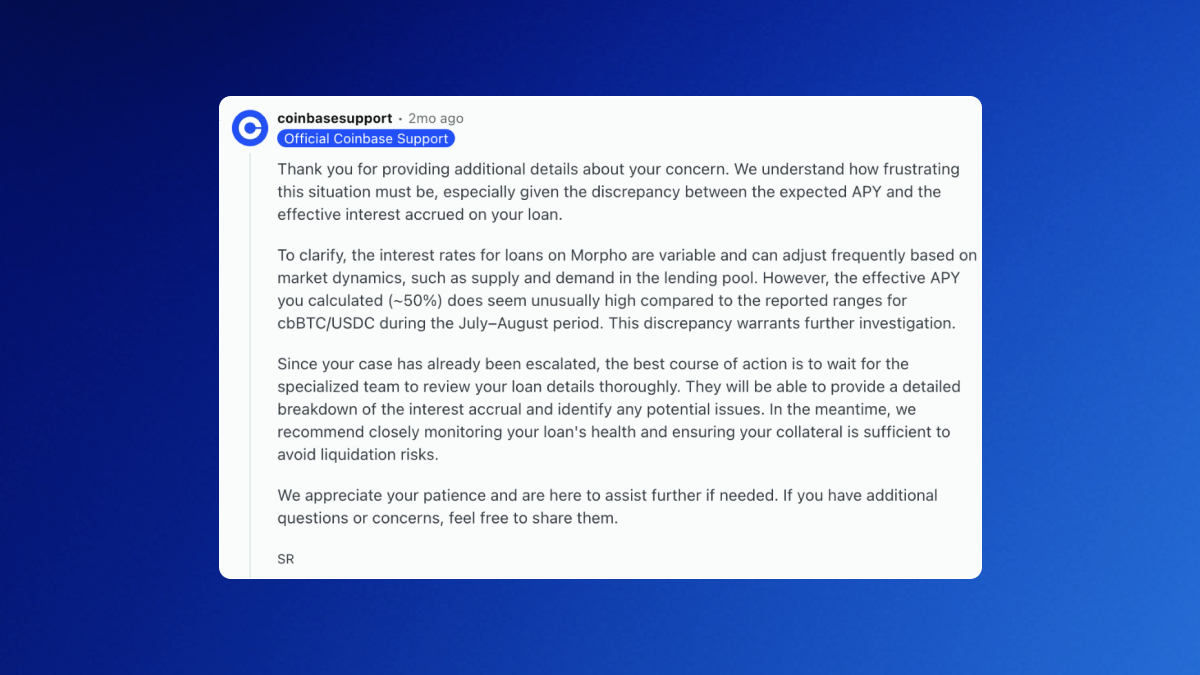

Coinbase / Morpho

With Coinbase (i.e. Morpho, the DeFi protocol Coinbase uses), rates are variable. They’re set algorithmically by Morpho based on supply and demand. In favorable markets, rates can go as low as ~5%, but the opposite can also be true. Since the rate fluctuates, your cost over time is uncertain.

Takeaway:

If you prefer predictability, APX’s fixed rates offer just that. If you're comfortable with rate swings and want to chase lower cost in favorable conditions, Coinbase’s variable model might appeal—but just remember it carries risk.

APX Lending

For CAD loans, we disburse your funds within 24 hours (often faster) once your collateral has arrived and been verified.

For USDC-type loans, funding is often nearly instantaneous upon confirmation.

Coinbase / Morpho

Disbursement is essentially instantaneous because everything is handled on-chain: your BTC is converted to cbBTC and locked into the Morpho smart contract, then USDC is issued.

Takeaway:

Coinbase has a slight edge in latency. But in many practical cases—including institutional or larger loans—the difference between “instant” and “within 24h” may not matter, especially given compliance checks.

APX Lending

We support Bitcoin (BTC) and Ethereum (ETH) as collateral, giving borrowers flexibility. You can borrow in USDC (for U.S. / cross border) or CAD and USDC (for Canadian users).

Coinbase / Morpho

Currently, only BTC collateral is eligible. When you pledge BTC, Coinbase converts it to cbBTC and locks it in a Morpho contract. Loans are disbursed in USDC.

Takeaway:

If you hold ETH (or want alt flexibility), APX gives you that choice. If your focus is BTC-only borrowing in USDC, Coinbase meets that, but with less optionality.

APX Lending

Terms span 3 to 60 months (i.e. up to five years). You can repay early at any time, and there’s no penalty beyond a small interest minimum in the first three months. You can also redraw (borrow again) up to your collateral limits, subject to maintaining safe LTV thresholds. Finally, you can extend your loan as often as you’d like.

Now, let’s talk about LTVs (loan-to-value ratios). On origination, users can draw at 20% - 60% LTV. It’s worth noting that a 60% origination LTV is the highest of any CeFi lender in the business. That means you can get more funds for your crypto and represent our belief in the asset class. Our liquidation LTV is 90%, another market leader.

In principle, APX Lending’s product was built to mimic a line of credit, and that’s exactly what it does.

Coinbase / Morpho

Since Morpho is a DeFi protocol, its loans are open-ended. In other words, there are no fixed terms or scheduled payment dates. You can repay (partially or fully) whenever you choose. Interest accrues until repayment.

Takeaway:

APX combines structure (terms) with flexibility (early payoff, redraw). Coinbase offers maximum fluidity—but that can lead to unpredictability.

APX Lending

We hold collateral in segregated cold storage, with rigorous custody security (e.g. BitGo Trust) and insurance coverage (up to ~$250M). Under our OSC exemptive relief, the collateral is held in SPVs, not rehypothecated, and APX does not accept deposits.

Coinbase / Morpho

You provide BTC, Coinbase converts it into cbBTC, and the cbBTC is locked into a Morpho smart contract. Liquidation and enforcement are handled by smart contract logic. If a liquidation happens, there is typically a ~4.38% penalty over the owed amount.

Smart contract architecture yields transparency and automation but also exposes you to the risk of bugs, protocol upgrades, and code vulnerabilities.

APX Lending

One of APX’s major differentiators is its regulatory alignment:

Coinbase / Morpho

Coinbase is a large, regulated crypto exchange / broker. But its lending arm is built via Morpho, a DeFi protocol. That means the lending side is less directly regulated. Crypto

As already noted, their earlier “Borrow” product was discontinued, likely in part due to regulatory flux.

Because the lending is protocol-based, it is more exposed to regulatory changes, interpretations, or enforcement risk.

APX Lending

We build for people, not just code. From onboarding to repayment, users get:

Coinbase / Morpho

In short: Coinbase’s UX is slick, but APX offers more accountability when things get complicated.

Shared risks

APX-specific

Coinbase / Morpho-specific

COMP CHART (CODE IN DYNAMIC RATES)

Coinbase’s model is powerful: instant, protocol-native, and fluid. For developers, traders, and those comfortable with volatility and smart contract risk, it’s a compelling tool.

But for most users who value confidence, predictability, and regulatory clarity, APX Lending offers a uniquely balanced path. Fixed rates (not subject to wild swings), insured custody, transparent terms, and regulatory backing make it a far more stable environment to borrow against your crypto—whether you’re in a highly regulated jurisdiction like Canada or the U.S.

APX Lending is a crypto-backed lender operating in the US, Canada, and globally. APX Lending does not offer financial or tax advice. We strongly encourage you to consult with a certified financial or tax professional for guidance on any related inquiries you may have.

Crypto-backed loans are no longer fringe.

As the market matures, the difference between safety, clarity, and risk becomes clearer. And more important.

In our corner, we believe in providing borrowers with liquidity without sacrificing control, clarity, and compliance. That’s central to how we do things and ultimately feeds into our mission.

To accelerate crypto adoption through trust, transparency, and regulatory excellence.

With that said: Let’s see how we stack up against Coinbase’s approach.

APX Lending

We offer fixed APRs based on loan size irrespective of loan term or LTV. We offer tiered rates: 11.49% APR (<$100K), 10.99% APR ($100K–$1M), and 9.99% APR (>$1M).

That said, we’re always negotiating better terms with our partners- so keep that in mind.

There are no origination fees or hidden charges, and interest is simple (i.e. you pay only on the principal outstanding).

Coinbase / Morpho

With Coinbase (i.e. Morpho, the DeFi protocol Coinbase uses), rates are variable. They’re set algorithmically by Morpho based on supply and demand. In favorable markets, rates can go as low as ~5%, but the opposite can also be true. Since the rate fluctuates, your cost over time is uncertain.

Takeaway:

If you prefer predictability, APX’s fixed rates offer just that. If you're comfortable with rate swings and want to chase lower cost in favorable conditions, Coinbase’s variable model might appeal—but just remember it carries risk.

APX Lending

For CAD loans, we disburse your funds within 24 hours (often faster) once your collateral has arrived and been verified.

For USDC-type loans, funding is often nearly instantaneous upon confirmation.

Coinbase / Morpho

Disbursement is essentially instantaneous because everything is handled on-chain: your BTC is converted to cbBTC and locked into the Morpho smart contract, then USDC is issued.

Takeaway:

Coinbase has a slight edge in latency. But in many practical cases—including institutional or larger loans—the difference between “instant” and “within 24h” may not matter, especially given compliance checks.

APX Lending

We support Bitcoin (BTC) and Ethereum (ETH) as collateral, giving borrowers flexibility. You can borrow in USDC (for U.S. / cross border) or CAD and USDC (for Canadian users).

Coinbase / Morpho

Currently, only BTC collateral is eligible. When you pledge BTC, Coinbase converts it to cbBTC and locks it in a Morpho contract. Loans are disbursed in USDC.

Takeaway:

If you hold ETH (or want alt flexibility), APX gives you that choice. If your focus is BTC-only borrowing in USDC, Coinbase meets that, but with less optionality.

APX Lending

Terms span 3 to 60 months (i.e. up to five years). You can repay early at any time, and there’s no penalty beyond a small interest minimum in the first three months. You can also redraw (borrow again) up to your collateral limits, subject to maintaining safe LTV thresholds. Finally, you can extend your loan as often as you’d like.

Now, let’s talk about LTVs (loan-to-value ratios). On origination, users can draw at 20% - 60% LTV. It’s worth noting that a 60% origination LTV is the highest of any CeFi lender in the business. That means you can get more funds for your crypto and represent our belief in the asset class. Our liquidation LTV is 90%, another market leader.

In principle, APX Lending’s product was built to mimic a line of credit, and that’s exactly what it does.

Coinbase / Morpho

Since Morpho is a DeFi protocol, its loans are open-ended. In other words, there are no fixed terms or scheduled payment dates. You can repay (partially or fully) whenever you choose. Interest accrues until repayment.

Takeaway:

APX combines structure (terms) with flexibility (early payoff, redraw). Coinbase offers maximum fluidity—but that can lead to unpredictability.

APX Lending

We hold collateral in segregated cold storage, with rigorous custody security (e.g. BitGo Trust) and insurance coverage (up to ~$250M). Under our OSC exemptive relief, the collateral is held in SPVs, not rehypothecated, and APX does not accept deposits.

Coinbase / Morpho

You provide BTC, Coinbase converts it into cbBTC, and the cbBTC is locked into a Morpho smart contract. Liquidation and enforcement are handled by smart contract logic. If a liquidation happens, there is typically a ~4.38% penalty over the owed amount.

Smart contract architecture yields transparency and automation but also exposes you to the risk of bugs, protocol upgrades, and code vulnerabilities.

APX Lending

One of APX’s major differentiators is its regulatory alignment:

Coinbase / Morpho

Coinbase is a large, regulated crypto exchange / broker. But its lending arm is built via Morpho, a DeFi protocol. That means the lending side is less directly regulated. Crypto

As already noted, their earlier “Borrow” product was discontinued, likely in part due to regulatory flux.

Because the lending is protocol-based, it is more exposed to regulatory changes, interpretations, or enforcement risk.

APX Lending

We build for people, not just code. From onboarding to repayment, users get:

Coinbase / Morpho

In short: Coinbase’s UX is slick, but APX offers more accountability when things get complicated.

Shared risks

APX-specific

Coinbase / Morpho-specific

COMP CHART (CODE IN DYNAMIC RATES)

Coinbase’s model is powerful: instant, protocol-native, and fluid. For developers, traders, and those comfortable with volatility and smart contract risk, it’s a compelling tool.

But for most users who value confidence, predictability, and regulatory clarity, APX Lending offers a uniquely balanced path. Fixed rates (not subject to wild swings), insured custody, transparent terms, and regulatory backing make it a far more stable environment to borrow against your crypto—whether you’re in a highly regulated jurisdiction like Canada or the U.S.

APX Lending is a crypto-backed lender operating in the US, Canada, and globally. APX Lending does not offer financial or tax advice. We strongly encourage you to consult with a certified financial or tax professional for guidance on any related inquiries you may have.