APX Lending’s 2025 year-end recap

A look back at APX Lending's first year: CSA authorization, market volatility, regulatory progress in Canada and the U.S., and what it means for the future of crypto-backed lending.

.jpg)

To date, over three trillion USD sits in cryptocurrency.

That’s a lot of wealth just sitting there.

Most financial services haven’t figured out how to create more value out of this wealth. This is where crypto-backed lending comes in.

Bitcoin and Ethereum are increasingly held long term by retail, high-net-worth, and institutional clients. These assets may be custodied at exchanges, held with qualified custodians, or self-custodied entirely. Whatever the case, they exist in financial ecosystems that financial platforms already serve.

The scale is significant. Chainalysis estimates that over 60% of circulating Bitcoin supply is held by long-term holders, while research from Fidelity Digital Assets points to rising demand for credit products that allow clients to access liquidity without selling their crypto.

In other words, the business opportunity is real. And it’s already been quantified.

Offering crypto-backed lending allows exchanges, fintechs, and regulated financial institutions to:

White-label crypto lending exists to make all the above simple and straightforward. It allows financial platforms to launch crypto-backed loans under their own brand, while relying on purpose-built infrastructure to handle custody, compliance, and risk.

Crypto-native platforms already have what lenders spend years trying to acquire:

What they often don’t have is the appetite to take on:

White-label crypto lending closes that gap. It allows platforms to offer crypto-backed loans under their own brand, while outsourcing the operational lift to regulated infrastructure.

For users, the value proposition is simple: access cash without selling Bitcoin or Ethereum and benefit from upside.

For platforms, it’s about turning passive balances into real value, for their customers and their underlying businesses.

On paper, building a lending product sounds manageable. In reality, lending is one of the most operationally demanding products in financial services.

To do it properly, platforms must solve for:

That’s before factoring in audits, security reviews, and incident response.

For most, this complexity pulls focus away from core roadmap priorities. It’s also why many early crypto lenders failed. Not due to lack of demand, but lack of controls.

White-label crypto lending platforms like APX Lending exist specifically to absorb this complexity, allowing partners to launch lending without rebuilding their stack or assuming unnecessary risk.

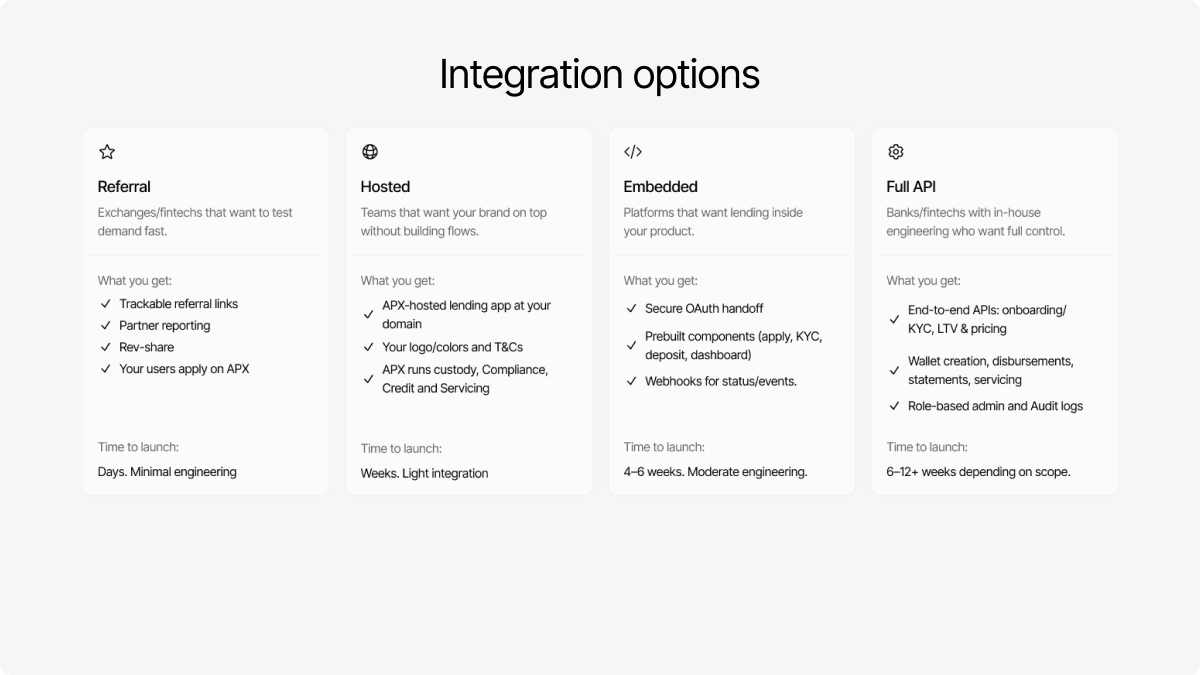

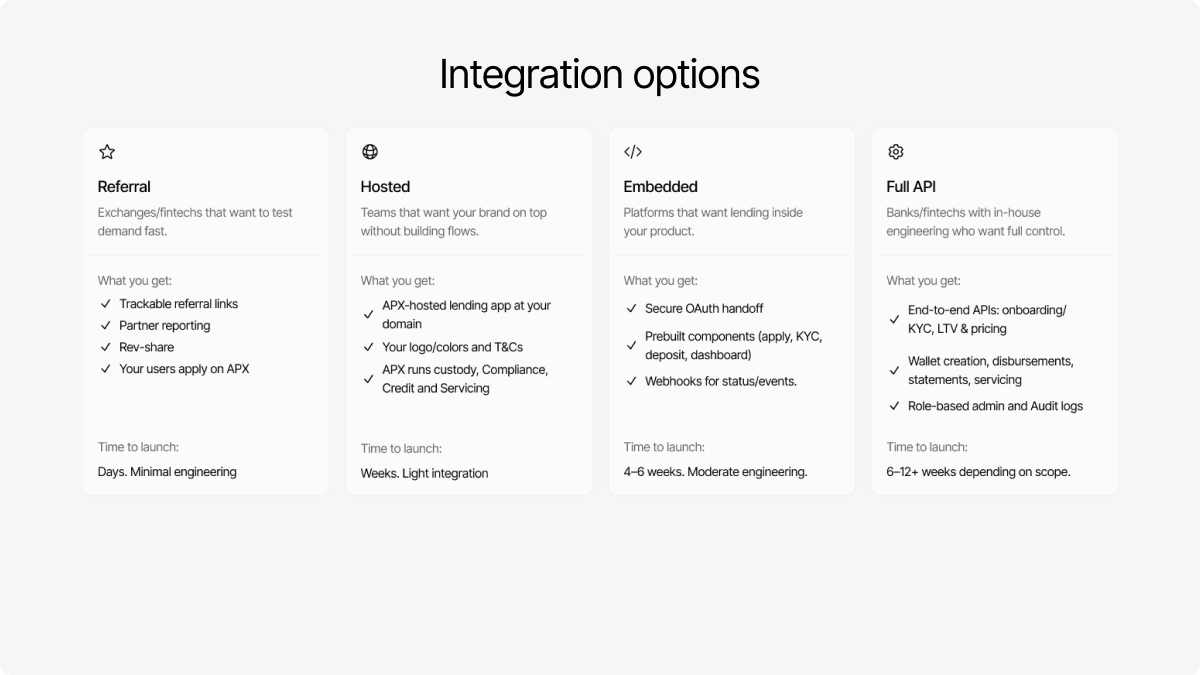

White-label lending isn’t a one-size-fits-all approach. Different platforms integrate at different depths depending on their technical maturity and product goals. Others, like APX Lending, provide total scalability, from lightweight referral programs to fully integrated platforms.

For platforms with engineering teams, lending can be embedded directly into existing apps via APIs. The loan experience feels native to users, while APX handles collateral management, underwriting, and servicing behind the scenes.

Platforms that want speed over customization can launch hosted lending flows branded to match their product. This is often the fastest path to market and a common starting point before deeper integration.

.png)

For ecosystem partners, including advisors, accountants, and crypto service providers, lending can be offered via iframe calculators or referral links embedded directly on partner sites. This lets you unlock crypto lending without the burden of technical lift.

Crypto lending has matured. The market has seen what happens when leverage, custody, and credit operate without oversight.

As the Bank for International Settlements (BIS) has repeatedly noted, lending against volatile assets requires robust risk management and regulatory alignment. The same conclusion has been reinforced by post-mortems on failed crypto lenders.

For platforms operating in North America and Europe, regulation is no longer optional. It’s table stakes, and it’s precisely what enables long-term growth.

APX Lending was built with this reality in mind:

This infrastructure allows platforms to offer lending without compromising user trust or regulatory standing.

Most crypto platforms consider three paths to lending:

DeFi protocols

Efficient and transparent, but incompatible with consumer protection requirements, compliance obligations, and brand control.

Offshore lenders

Fast-moving, but introduce jurisdictional, counterparty, and reputational risk, especially for consumer-facing platforms.

White-label, regulated infrastructure

Combines crypto-native lending with institutional safeguards, allowing platforms to scale lending without absorbing full risk.

For platforms planning to operate long term, the choice is increasingly clear.

While crypto exchanges are leading adoption, traditional financial institutions are beginning to follow.

Banks and fintechs are exploring crypto-backed lending as a way to offer digital asset exposure without holding crypto directly. White-label infrastructure allows them to partner with crypto-native platforms rather than compete with them.

For exchanges, this opens up:

Scaling across North America and Europe

North America remains the core market for regulated crypto lending, but Europe is emerging quickly. Germany, in particular, has taken a more structured approach to digital asset regulation, creating opportunities for compliant lending products.

White-label infrastructure allows platforms to expand regionally without re-architecting their lending stack for each market—a meaningful advantage as crypto lending expands across markets.

White-label crypto lending allows platforms to add a capital-intensive product without becoming a capital-intensive business.

You control the brand, the user experience, and the customer relationship. APX operates behind the scenes, managing custody, customer support, compliance, and risk.

That separation is what makes white-label lending scalable.

If you’re exploring white-label crypto lending, whether through full API integration or lightweight embedded solutions, get in touch with APX Lending to discuss how it could work for your platform.

APX Lending is a crypto-backed lender operating in the US, Canada, and globally. APX Lending does not offer financial or tax advice. We strongly encourage you to consult with a certified financial or tax professional for guidance on any related inquiries you may have.

To date, over three trillion USD sits in cryptocurrency.

That’s a lot of wealth just sitting there.

Most financial services haven’t figured out how to create more value out of this wealth. This is where crypto-backed lending comes in.

Bitcoin and Ethereum are increasingly held long term by retail, high-net-worth, and institutional clients. These assets may be custodied at exchanges, held with qualified custodians, or self-custodied entirely. Whatever the case, they exist in financial ecosystems that financial platforms already serve.

The scale is significant. Chainalysis estimates that over 60% of circulating Bitcoin supply is held by long-term holders, while research from Fidelity Digital Assets points to rising demand for credit products that allow clients to access liquidity without selling their crypto.

In other words, the business opportunity is real. And it’s already been quantified.

Offering crypto-backed lending allows exchanges, fintechs, and regulated financial institutions to:

White-label crypto lending exists to make all the above simple and straightforward. It allows financial platforms to launch crypto-backed loans under their own brand, while relying on purpose-built infrastructure to handle custody, compliance, and risk.

Crypto-native platforms already have what lenders spend years trying to acquire:

What they often don’t have is the appetite to take on:

White-label crypto lending closes that gap. It allows platforms to offer crypto-backed loans under their own brand, while outsourcing the operational lift to regulated infrastructure.

For users, the value proposition is simple: access cash without selling Bitcoin or Ethereum and benefit from upside.

For platforms, it’s about turning passive balances into real value, for their customers and their underlying businesses.

On paper, building a lending product sounds manageable. In reality, lending is one of the most operationally demanding products in financial services.

To do it properly, platforms must solve for:

That’s before factoring in audits, security reviews, and incident response.

For most, this complexity pulls focus away from core roadmap priorities. It’s also why many early crypto lenders failed. Not due to lack of demand, but lack of controls.

White-label crypto lending platforms like APX Lending exist specifically to absorb this complexity, allowing partners to launch lending without rebuilding their stack or assuming unnecessary risk.

White-label lending isn’t a one-size-fits-all approach. Different platforms integrate at different depths depending on their technical maturity and product goals. Others, like APX Lending, provide total scalability, from lightweight referral programs to fully integrated platforms.

For platforms with engineering teams, lending can be embedded directly into existing apps via APIs. The loan experience feels native to users, while APX handles collateral management, underwriting, and servicing behind the scenes.

Platforms that want speed over customization can launch hosted lending flows branded to match their product. This is often the fastest path to market and a common starting point before deeper integration.

.png)

For ecosystem partners, including advisors, accountants, and crypto service providers, lending can be offered via iframe calculators or referral links embedded directly on partner sites. This lets you unlock crypto lending without the burden of technical lift.

Crypto lending has matured. The market has seen what happens when leverage, custody, and credit operate without oversight.

As the Bank for International Settlements (BIS) has repeatedly noted, lending against volatile assets requires robust risk management and regulatory alignment. The same conclusion has been reinforced by post-mortems on failed crypto lenders.

For platforms operating in North America and Europe, regulation is no longer optional. It’s table stakes, and it’s precisely what enables long-term growth.

APX Lending was built with this reality in mind:

This infrastructure allows platforms to offer lending without compromising user trust or regulatory standing.

Most crypto platforms consider three paths to lending:

DeFi protocols

Efficient and transparent, but incompatible with consumer protection requirements, compliance obligations, and brand control.

Offshore lenders

Fast-moving, but introduce jurisdictional, counterparty, and reputational risk, especially for consumer-facing platforms.

White-label, regulated infrastructure

Combines crypto-native lending with institutional safeguards, allowing platforms to scale lending without absorbing full risk.

For platforms planning to operate long term, the choice is increasingly clear.

While crypto exchanges are leading adoption, traditional financial institutions are beginning to follow.

Banks and fintechs are exploring crypto-backed lending as a way to offer digital asset exposure without holding crypto directly. White-label infrastructure allows them to partner with crypto-native platforms rather than compete with them.

For exchanges, this opens up:

Scaling across North America and Europe

North America remains the core market for regulated crypto lending, but Europe is emerging quickly. Germany, in particular, has taken a more structured approach to digital asset regulation, creating opportunities for compliant lending products.

White-label infrastructure allows platforms to expand regionally without re-architecting their lending stack for each market—a meaningful advantage as crypto lending expands across markets.

White-label crypto lending allows platforms to add a capital-intensive product without becoming a capital-intensive business.

You control the brand, the user experience, and the customer relationship. APX operates behind the scenes, managing custody, customer support, compliance, and risk.

That separation is what makes white-label lending scalable.

If you’re exploring white-label crypto lending, whether through full API integration or lightweight embedded solutions, get in touch with APX Lending to discuss how it could work for your platform.

APX Lending is a crypto-backed lender operating in the US, Canada, and globally. APX Lending does not offer financial or tax advice. We strongly encourage you to consult with a certified financial or tax professional for guidance on any related inquiries you may have.