Compliant crypto-backed lending

Secure, compliant lending for individuals and institutions.

Loans

Lending options for retail borrowers.

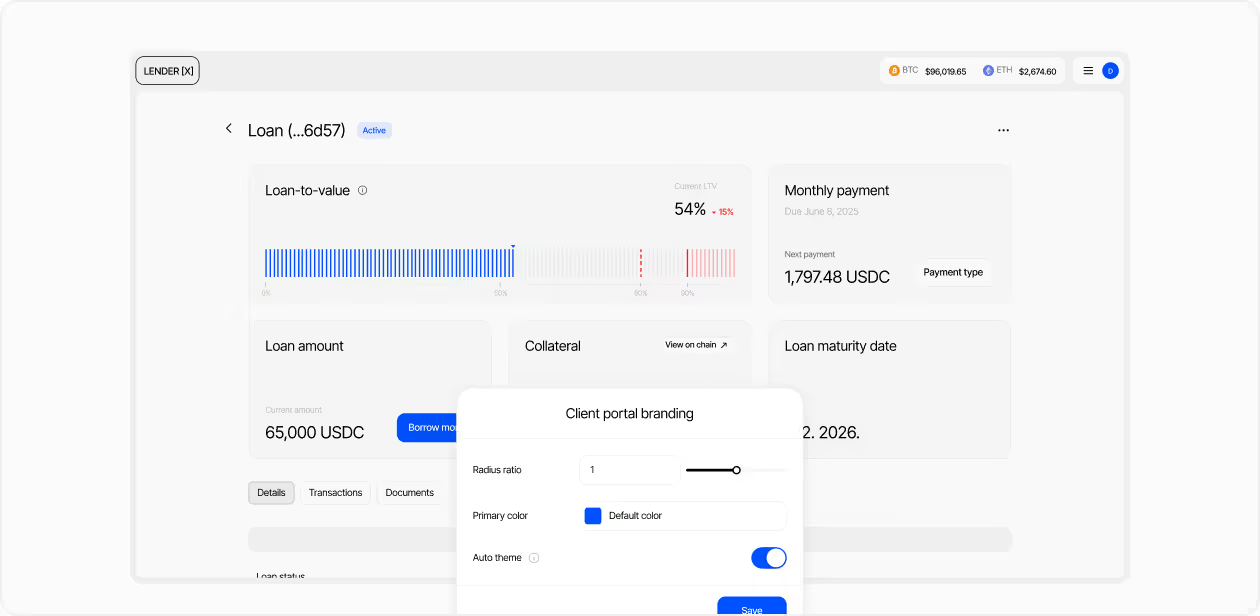

White Label

Institutional lending under your own brand.

Who APX helps

See how different types of borrowers use APX—and the value our products deliver for each.

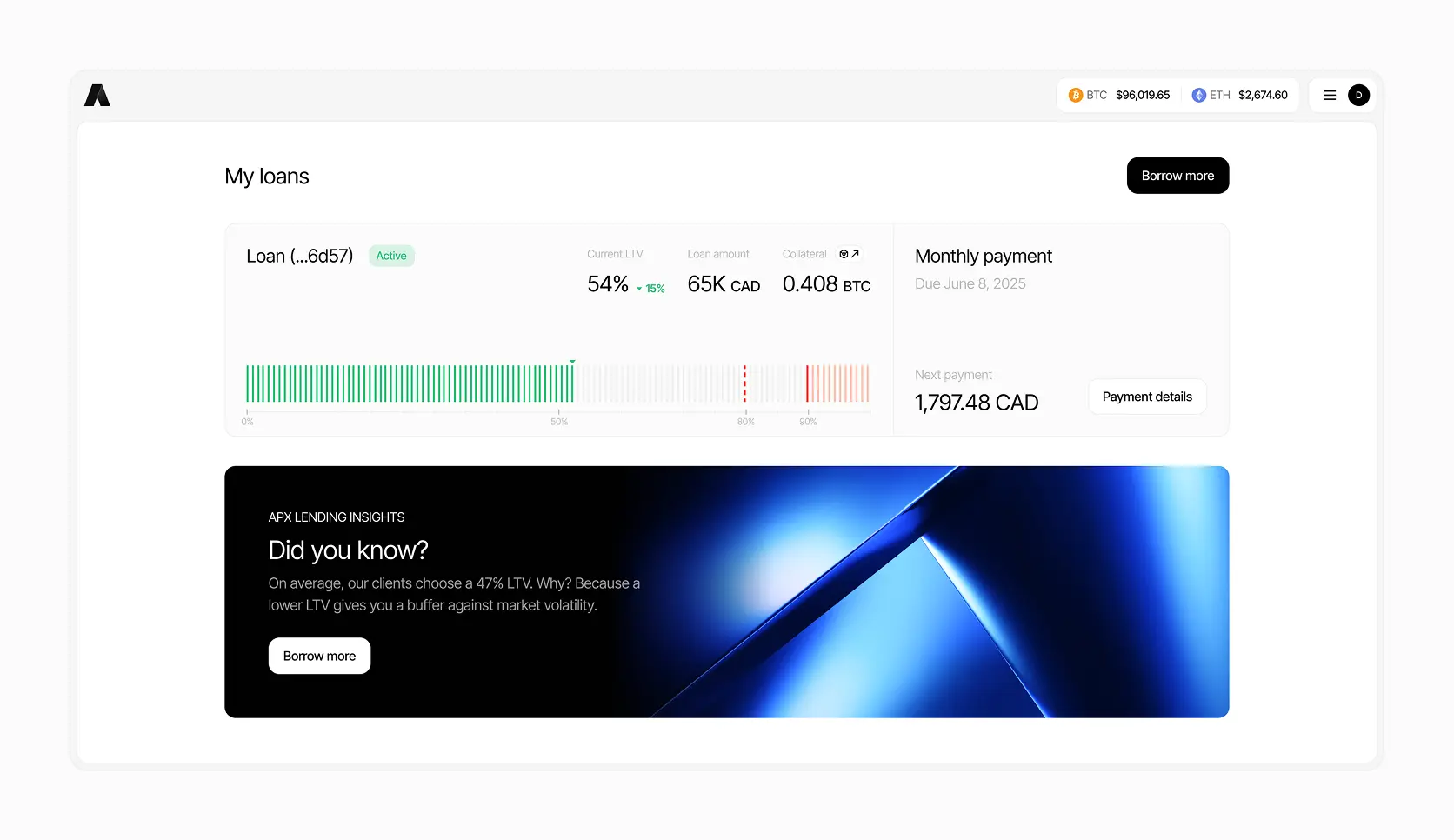

High-net-worth individuals

Access tax-efficient liquidity and protect upside with transparent, real-time LTV tools.

Miners

Get higher LTV, lower liquidation risk, and operating capital without selling your stack.

Unlock smarter crypto moves

From quick explainers to advanced tools. No jargon, just insights.

Blogs

Market trends, tax tips, and borrower stories.

Crypto loans guide

How crypto loans work and how to borrow safely.

Crypto loan calculator

Check borrowing power, LTV, and liquidation buffer.

Support

Live chat or step-by-step guides anytime.

Referral program

Get rewards when you refer a borrower.

About APX Lending

CSA-compliant lending made safe, fast, and flexible.

About

Our story, leadership, and compliance foundation.

Trust

Governed by FINTRAC, FinCEN, CSA frameworks.

Security

Cold storage, SOC 2 audits, and $250M insurance.

.svg)

.avif)

%20(1).avif)

.webp)